WARNING: Inflation Ahead

What does inflation mean for the tenant, the real estate investor, and the government?

A tenant walks into a bar and asks the bartender for a stiff drink.

The bartender says, “That will be $10.”

“$10!!!” Says the tenant. “It was $8 last week! Ok put it on my card, I’ll just go deeper into debt!” (victim mentality)

A real estate investor walks into the same bar and asks the bartender for a stiff drink.

The bartender says, “That will be $10.”

“$10!!!” Says the investor. “ It was $8 last week! Ok here’s $10. I don’t want to hold onto cash anyway, I only hold assets.” (understands the importance of assets)

Uncle Sam walks into the same bar and asks the bartender for a stiff drink.

The bartender says, “That will be $10.”

“$10!!!” Says Uncle Sam. “ It was $8 last week! I was hoping to pay $15.”

The bartender says, “$15? Why would you want to pay more?”

Uncle Sam replies, “Because the more inflation we have, the cheaper my old debt becomes and the cheaper my new debt looks. Win-Win.”

We all see inflation differently and it’s important to understand why. But first, we have to ask, what is inflation? Put simply, inflation is a reduction in our purchasing power. What something costs tomorrow will be more than it costs today. That is a fact.

But is inflation good or bad?

That is where things become less black and white.

Is Inflation Good for Wage Earners, Investors, or the Government?

If your income is not growing, inflation is not your friend. W-2 wage earners feel the most negative effect of inflation because they think of money in terms of cash or how much is in their bank account. As a result, not only will what they buy cost more but also their standard of living will go down over time because what’s in the bank account is losing purchasing power daily.

Maybe instead of a steak dinner every Sunday with the family, it becomes a meatloaf dinner.

Inflation is “less bad” for real estate investors. Sure, they too will be paying more for the stiff drink, and for groceries, and for gas, just like the W-2 wage earner, but, because they think of money in terms of assets, their assets (i.e. property values) will rise with inflation and so their wealth (what’s in their so-called “bank account” is preserved). In this way, they maintain at least a sort of status-quo, if not an improved situation because, with inflation, their fixed debt payments are made with cheaper dollars.

The government loves inflation, and they would be dancing in the streets for even higher inflation if not for major backlash from the public. The government and the FED temper their messaging on inflation in their press releases as to not be giddy by instead calling it “transitory” and thus lulling the population into thinking it’s going to go away soon.

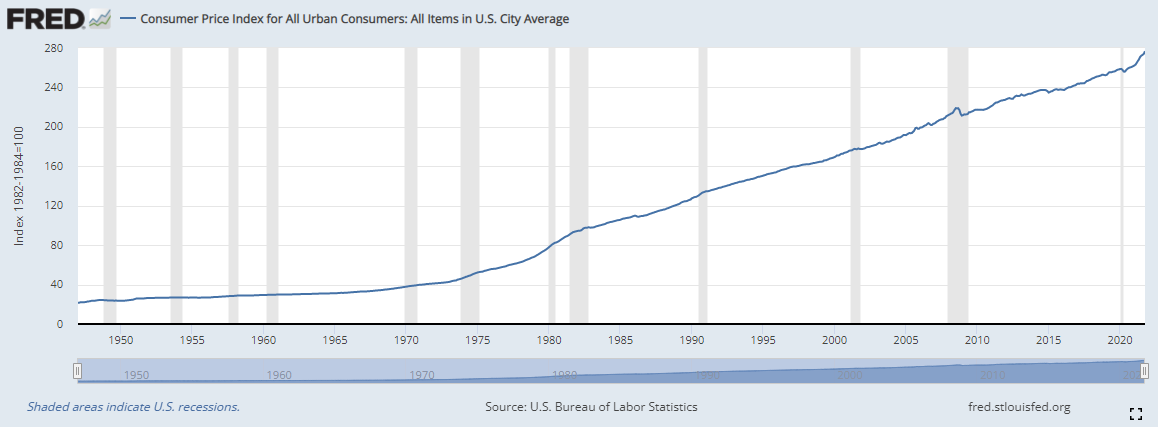

The reality is that we’ve had steady inflation for years.

From the St Louis Fed website – “The Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL) is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.”

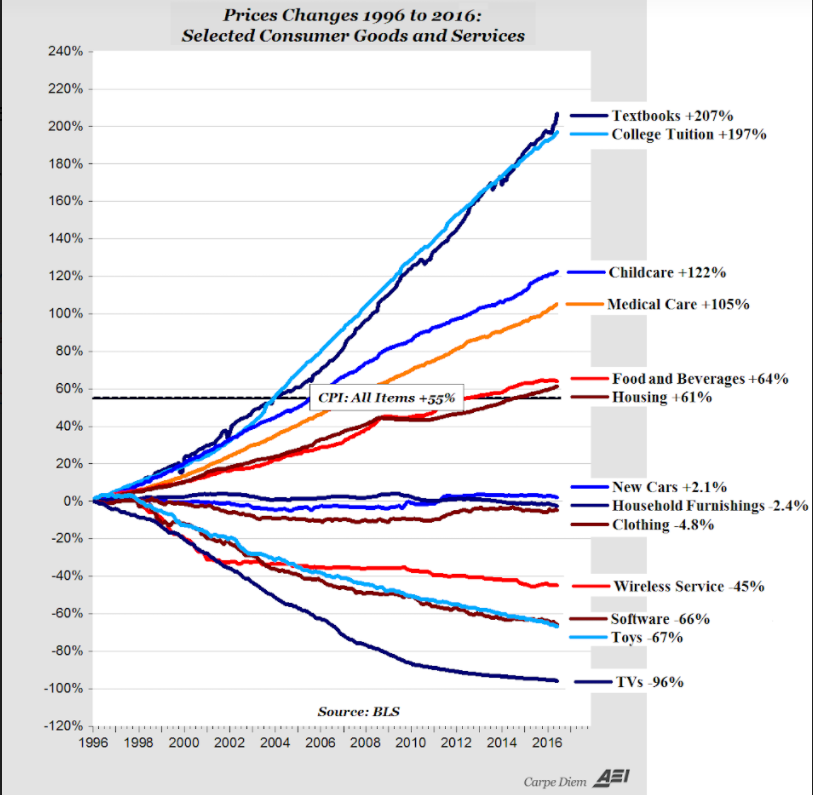

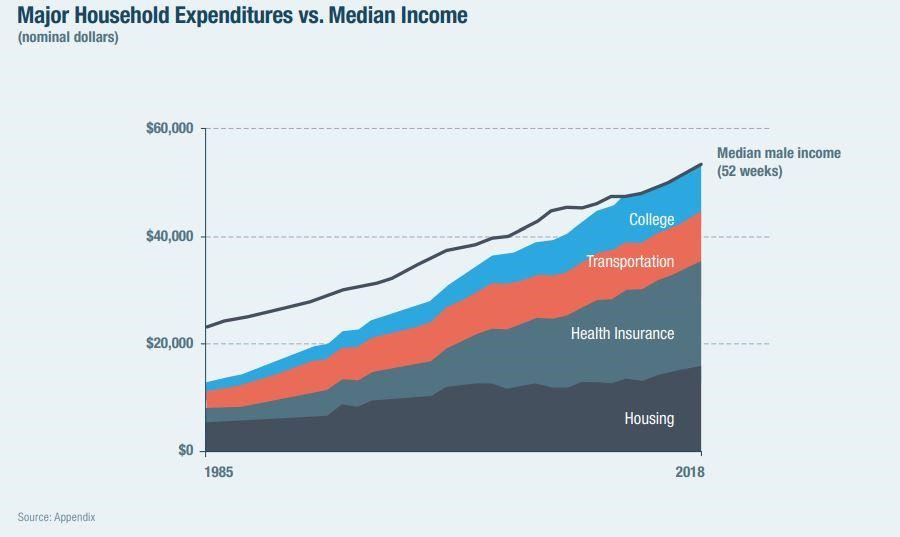

Here’s a chart that makes the same point but may be more relatable to what we’ve been seeing for years.

Why Do Governments Prefer Inflation?

The truth is that inflation is the least bad (i.e. best) option for governments because it makes their fixed debt payments cheaper and it makes future borrowing cheaper as well. The debt payments are fixed (think of your mortgage) but the dollars you’re using to pay them are worth less…..so the debt is cheaper.

Let’s briefly explore the other (i.e. “worse”) options.

Another option is to default on the debt. Much like anyone who finances a car and fails to make the monthly payments (i.e. defaults), the dealership will take the car away and the borrower will have a negative impact on their credit score. The same is true for the government. If the US does not pay its debt to other major countries, there will be backlash, potentially in the form of wars but most certainly as a downgrade of the US creditworthiness.

The next option is austerity. This is nothing more than the US tightening the purse strings and cutting back on spending. Unfortunately, that too is a problem because cutting spending on social programs will most likely lead to unrest, poverty, and revolt or overthrow of the government.

Plus, cutting government spending will not only reduce social programs but also lead to greater unemployment since nearly two million people work for the USG.

So, inflation in moderation is the less bad (i.e. best) solution for governments.

What Causes Inflation?

There are three ways we can create inflation:

- Increase the supply of dollars. More dollars injected into the economy will be competing for the same amount of goods and services resulting in inflation.

- Increased velocity in spending. When I go out to dinner, I leave a tip, that tip is then used by the waiter to get an Uber, the Uber driver then uses that dollar to buy tires for their car. That’s velocity…..the same dollar being spent over and over again. When there’s an appetite for consumers to spend there will be more velocity.

- Scarcity of goods and services. If there’s less available of what I need, then I’m willing to pay more (i.e. inflation). Assuming I have more dollars (#1 above).

It’s worth noting that inflation does not affect all things equally. Smart TV’s used to cost $2,000+. Now, you can buy them for $400 at Walmart.

Why?

Geographic and geopolitical conditions, as well as advances in technology all have a big influence on inflation. Tech products are less prone to inflation because many of them are produced overseas in cheap labor markets with highly automated equipment.

What About Real Estate Inflation?

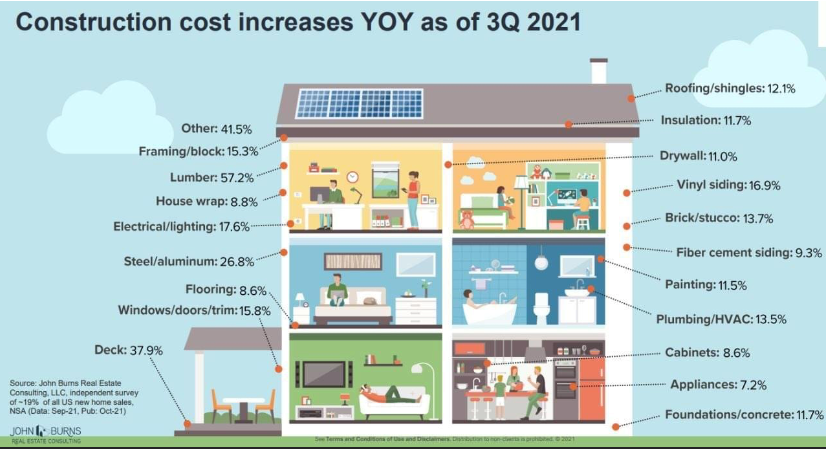

Unlike tech products, housing costs are geographic, you can’t import them. So when demand for housing increases, it takes time to match that demand and, as a result, demand outpaces supply resulting in inflation in the goods to build a house.

The Manhattan Institute wrote a great article explaining their Cost-of-Thriving Index: which can be found here.

In short they get into many more valid points that lead to this this chart showing how in 1985 it took 33 weeks of income to buy a years worth of goods and services. Fast forward to 2020, that same basket of goods and services now requires 53 weeks of income. (yes, 53 weeks, that is not a typo)

For the real estate investor, this is important to understand. When it comes to the relationship between inflation and real estate, there has been a leveling off of housing as an expense when compared to the other expenses. As expenses rise, something needs to give. I have seen a shift in tenants reducing the footprint of their living space. Whereas they used to rent a two-bedroom apartment they are now opting for a one-bedroom and otherwise being more creative by utilizing space in their living room for their office or as the baby’s room. Less to pay for…less to heat.

Chances are they will not go without their iPhone or give up their car to start taking public transportation.

Thus, inflation’s effect on real estate leads to increased housing prices, which in turn leads to behavior changes in tenants–changes that real estate investors must take into account when choosing investment properties that will maintain the same (or increased) demand and provide consistent returns.

What Does Inflation Mean for the Future?

The big question becomes: What does the future hold? For the tenant, the real estate investor, and the government?

We see that the government has no other choice but to continue to support inflation. There will inevitably be brief moments of deflation but decades of history already clearly show inflation will continue.

For the real estate investor, assets continue to be the way to go to preserve and create new wealth.

Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.

~Andrew Carnegie

For tenants and W-2 wage earners, the struggles will continue.

To change the cycle, one must have the discipline to invest in themselves first through education. This can be done with something as simple as creating an hour out of each day to read books or articles or to watch successful people on social media platforms on how they created their freedom.

Fortunately, there are tons of people around who are willing and able to help. Find the right one for you and the sky’s the limit.