Join Our Real Estate

Syndication

Increase your freedom with passive investments through Dirty Boots Capital’s

Real Estate Syndications.

Join Our Real Estate Syndication

Increase your freedom with passive investments through Dirty Boots Capital’s Real Estate Syndications.

Investment opportunities

Have you become wary of Wall Street despite getting great stock market returns? Are you looking to diversify your portfolio to protect your wealth and legacy as economic and political tides change and society’s sentiments toward the wealthy put your financial safety at risk?

It’s time to turn to real estate investment.

If you want the benefits of investing in real estate without all the work, let us get our boots dirty for you. At Dirty Boots Capital, we help investors seeking a hands-off experience to invest in real estate syndications. We do all the work to find the deals, physically look at properties, put together the team, research the financials, and make investments on your behalf.

Let us simplify the process to help you preserve your wealth, provide cash flow, gain tax benefits, and create something to pass down to the next generation.

Learn More About Real Estate Basics

- Real estate basics

- Investing basics

- Real estate terms

- Types of real estate

Webinar: What is Real Estate Syndication?

A real estate syndication is simply many people pooling their investment dollars together to purchase real estate that they normally would not be able to purchase on their own. Real estate syndications provide people the opportunity to invest in certain assets that they may know little about other than that it is an up and coming trend, such as mobile home parks, storage units, warehouses, etc. The general partners in the syndication will have the expertise to select the best assets for your investment dollars.

Yes, Dirty Boots Capital is both a GP and an LP. As a limited partner (LP) we invest our money with general partners (GP) that we know and trust. Because we’re well connected to several GPs sometimes we will occasionally partner with them as a GP when it meets the needs of our clients. Either way, we look to provide investors the best solution which may not always be to invest with us directly.

An active investor participates in the daily, weekly, and monthly management of a property, whereas a passive investor relies on professionals to manage the property on their behalf. If you work for Apple and have stock, you are an active investor in Apple. If you are retired and own Apple stock, you are a passive investor.

Yes and no. According to the answer above, you can be an active real estate investor through hands-on management, or a passive real estate investor through a syndication or other investment approach that puts the management responsibilities in the hands of someone else.

Author, Chicken Soup for the Soul.

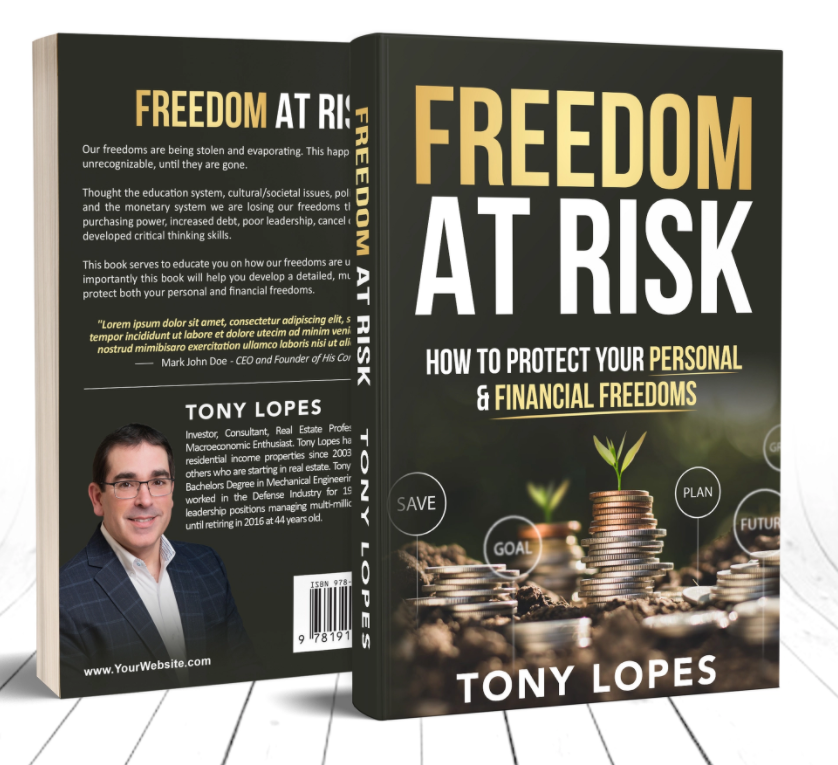

Tony’s Book, “Freedom At Risk: How To Protect Your Personal And Financial Freedoms”

Coming Soon

Get the Book:

"Freedom at Risk"

by Tony Lopes

Gain a greater appreciation of the interdependencies among education, politics, the economy, money, culture, society, and how each impacts your freedoms. Learn to see the changes happening in the world so you can formulate a plan to protect and maximize your personal and financial freedoms.

Latest Blogs

January 31, 2025

December 30, 2024

December 12, 2024

November 7, 2024

October 16, 2024

May 17, 2024

March 13, 2024