While it makes complete sense, it still amazes me that many real estate investors do not look at demographics when determining where to invest. Many investors look at the price of the property, the cap rate, and the cash flow–which are also super important–but forget the equally important factor of demographics.

What are demographics? When it comes to real estate, they are the factors that represent THE CLIENT base that you will be renting to in your specific location of interest.

Think of it this way. Would you open an ice cream store in Alaska or Florida? Florida is likely the better choice because of the higher populous demand for ice cream due to the heat, humidity, and proximity to beaches.

Now, take it one step further. Would you open that Florida ice cream store in an industrial park or in a residential location with many schools? You would most likely open it in a residential area due to the good demographics of families and children.

You see where I’m going with this.

Real estate investing is no different. It is important to study the demographics (the client or otherwise your customer) of the location you’re looking to buy in.

Demographic Factors Affecting Real Estate

Here’s an abbreviated list of different factors that you can research in your desired search location to determine if the demographic will support your investment:

- Income levels

- Poverty rate

- Unemployment rate – historical vs. current

- Percentage of renters vs. buyers

- Age groups (24-30, 65+, etc.)

- Single vs. married

- Female vs. male population

- College students vs. blue collar vs. white collar

- Education levels (high school, some college, college grad, post-college)

- Population growth/decline (by age and sex)

The more information you can get on demographics the better you will be able to identify who your clientele will be. It will also help you determine which type (i.e. asset class) of investment property is right for you.

Age Demographics Affecting Real Estate

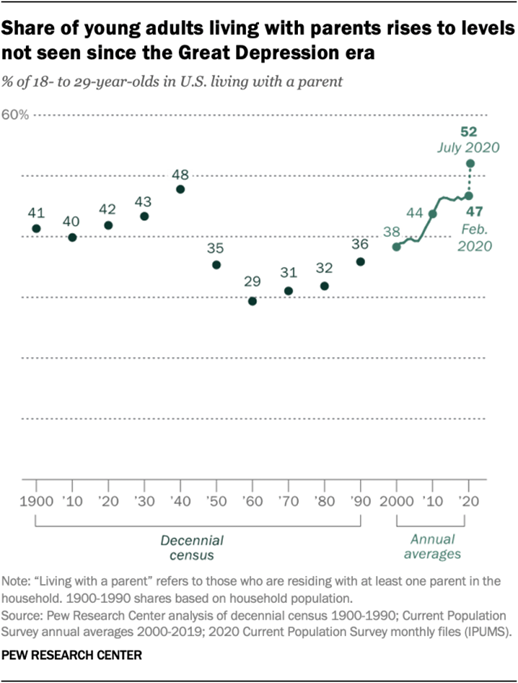

Historically, we are at a point where more than half of the young adults today (age 18-29) are still living at home with their parents. Note in the chart below how this has been steadily rising since 1960.

How does this impact your real estate investment choices?

Eventually, these young adults will either be unencumbered by student loans or perhaps they will find a mate to rent an apartment with. That’s great for real estate investors.

However, you will still need to assess whether this demographic will be renting the $2500/month apartment or the $1500/month apartment.

The Renter Nation

Consider this, in the 1950’s when the ranch-style home reached popularity, it was affordable for a family of four to buy a home even if the sole income generator (typically the husband) was a blue collar skilled carpenter or otherwise worked in the trades.

Contrast that with today. It’s improbable that you will see that scenario play out at all. Today’s demographic has been impacted by lackluster wage growth on the one hand and inflated home prices on the other.

The result?

Home buying has become extremely difficult.

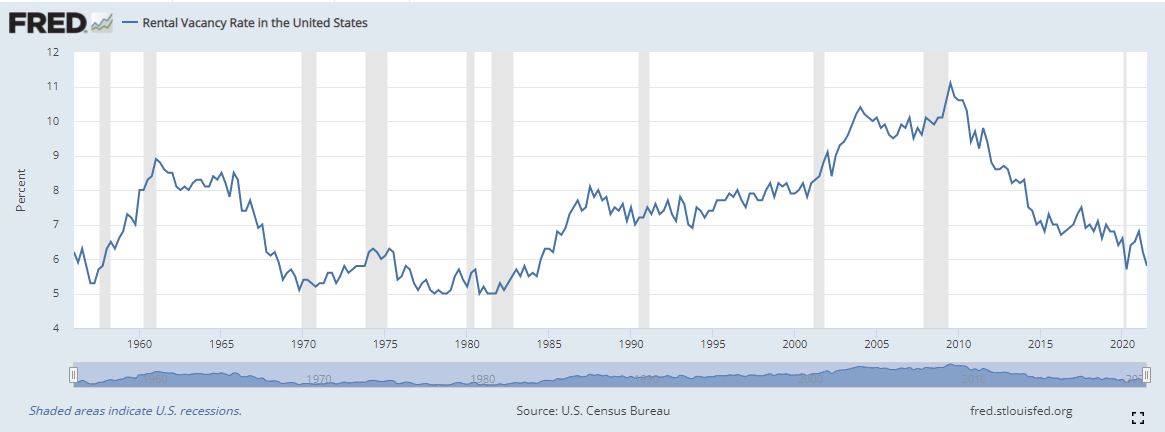

As housing has become more unaffordable it has pushed the population into rental housing–a phenomena dubbed “Renter Nation”.

In the chart below you can see how rental vacancy rates have dropped since 2010, caused by the housing affordability issue in the US, and again showing how we are increasingly a “Renter Nation”.

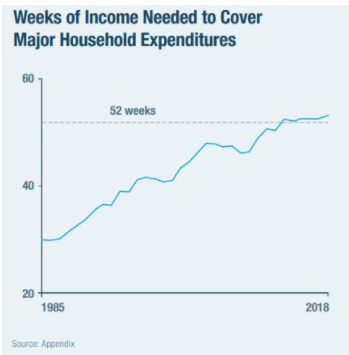

The chart below, from The Manhattan Institute, shows just how much inflation and the affordadility crisis has impacted the renter/buyer in the last 35 years. In 1985, they identified that it would take 30 weeks of income to cover the costs of a “basket of goods” (groceries, health care, housing, education, etc.) for the entire year.

When compared to 2018, that same “basket of goods”, now costs an individual 53 weeks of work. Yes, 53 weeks out of a 52-week calendar year! That clearly shows how inflation and wage stagnation has impacted the renter/buyer pool.

So, when we seek a location to invest in rental properties we need to keep this affordability crisis in mind and ensure that there are good employers and good wage growth potential in the area (hospitals, manufacturing, schools, retail, etc).

Male vs. Female Demographics and Real Estate

Moving now to the demographic of male vs. female. How might data on this seemingly simple population impact you as a real estate investor?

Let’s look at current trends.

It is a well-known fact of recent years that women have been getting married later in life. Women generally gravitate towards men who make the same or more income than they do at their respective jobs. However, as that window has closed and as we’ve just shown how inflation is making us poorer, women increasingly prefer to marry later in life when they and their male counterpart are more financially stable.

How does this impact real estate? Typically, this means that they are living on their own longer, most likely in a rental apartment where they don’t have to do maintenance and repairs.

What else does that mean to you as a real estate investor? It shows that if that’s a prevailing demographic in your location of interest, you will want to purchase with a female’s perspective in mind. Is it a safe neighborhood? Is there designated parking? Is there a washer/dryer in the unit or do they need to use the nearest laundromat facilities?

What about your pet policy? All renters are trending towards having pets vs. children, and generally, women are more likely to have pets than are males. Women are innately caregivers and like to come home to another living being. So, does the property you’re looking at have a grassy area for pets or is it near a dog park?

Real Estate Demographics Are Key

In conclusion, as with the demographics above, male vs. female, age groups, and income levels, we can explore how other demographics impact the real estate investor.

This exercise is certainly not meant to paralyze or scare investors…more so it’s to educate them to put equal emphasis on demographics as they do on the purchase price and cap rate.

Most importantly, never feel like you have to go it alone.

We are here to help you navigate through an array of situations. Whether it be assessing demographics in your area, calculating cap rates, determining which value-add projects to perform, determining the correct purchase price, or writing up your offer letter, we’re here for you.

Happy investing my friends!